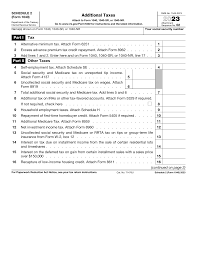

IRS Schedule 2 Tax Form

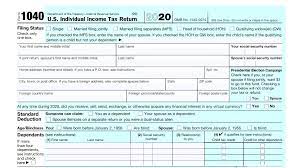

Printable IRS 1040 Tax Forms

IRS Tax Form Instructions

The Internal Revenue Service (IRS) has announced updates to the Schedule 2 tax form and instructions for the upcoming tax years of 2023 and 2024.

TRAVERSE CITY, MI, US, January 13, 2024 /EINPresswire.com/ — The Internal Revenue Service (IRS) has announced updates to the Schedule 2 tax form and instructions for the upcoming tax years of 2023 and 2024.

The Schedule 2 form is used to report additional taxes owed such as alternative minimum tax or excess advance premium tax credit repayment.

According to the new Schedule 2 instructions, the form will require additional information such as the amount of excess advance premium tax credit repayment for the year and the amount of tax due on the excess repayment. Taxpayers will also need to provide details on any alternative minimum tax owed for the year.

In addition, the IRS has updated the instructions to provide clarity on how to calculate the alternative minimum tax and how to report it on the Schedule 2 form. Taxpayers are encouraged to carefully review the updated instructions to ensure accurate reporting and avoid potential penalties.

The Schedule 2 form and instructions for 2023 and 2024 are designed to help taxpayers fulfill their tax obligations and ensure compliance with federal tax laws. The IRS recommends that taxpayers use tax preparation software or consult with a qualified tax professional to accurately complete the form.

Taxpayers should note that failure to report all income and pay all taxes owed can result in penalties and interest charges. The IRS offers various payment options and installment agreements for taxpayers who are unable to pay their tax bill in full.

Overall, the updates to the Schedule 2 tax form and instructions aim to provide taxpayers with clear guidance on reporting additional taxes owed and help them fulfill their tax obligations.

Taxpayers are encouraged to review the updated form and instructions at, https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

Frank Ellis

Harbor Financial

email us here

Visit us on social media:

LinkedIn

![]()

Originally published at https://www.einpresswire.com/article/681086131/irs-releases-updated-schedule-2-tax-form-and-instructions-for-2023-and-2024-announced-by-harbor-financial